The Luxury Index: Top Ten Cities

Now in its third year, the Christie’s International Real Estate Index gives luxury rankings to the year’s 10 top performing cities across the globe

Now in its third year, the Christie’s International Real Estate Index gives luxury rankings to the year’s 10 top performing cities across the globe

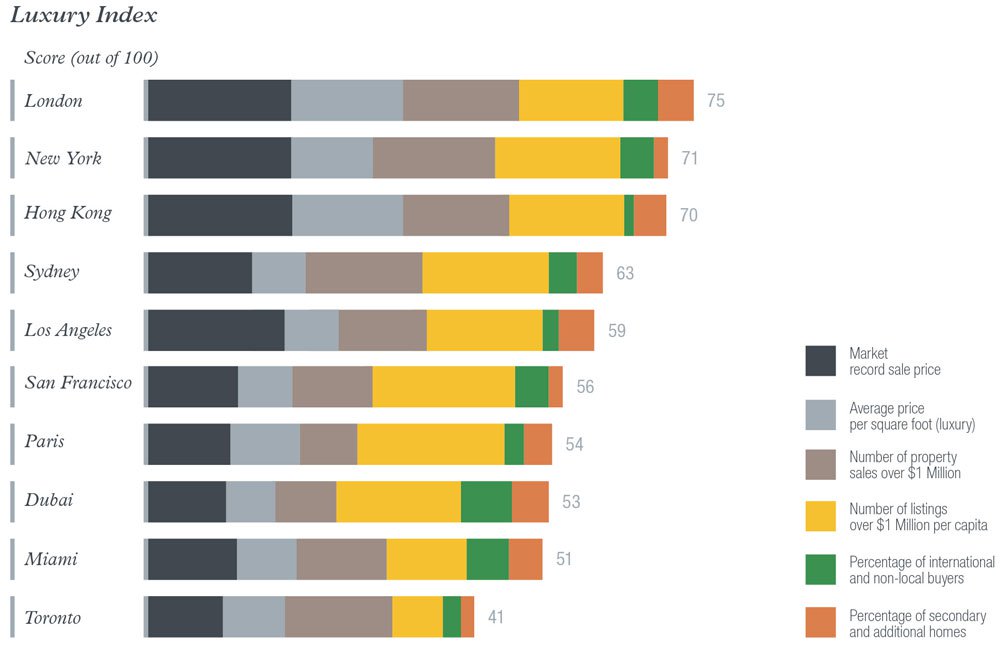

Ranking the world’s top luxury real estate markets can be best achieved by observing two types of market dynamics: those that measure the relative ‘luxuriousness’ of a market and those that take its overall ‘temperature.’ In previous years, the Christie’s International Real Estate Index—a comparison of the world’s top 10 performing luxury residential housing markets compiled for our annual Luxury Defined white paper—reviewed both factors and gave an overall score to each market.

In order to better evaluate the relative annual performance of the top housing markets, this year’s Index aggregates residential data for each city and presents a corresponding score out of a possible 100 for both luxury and market-temperature categories.

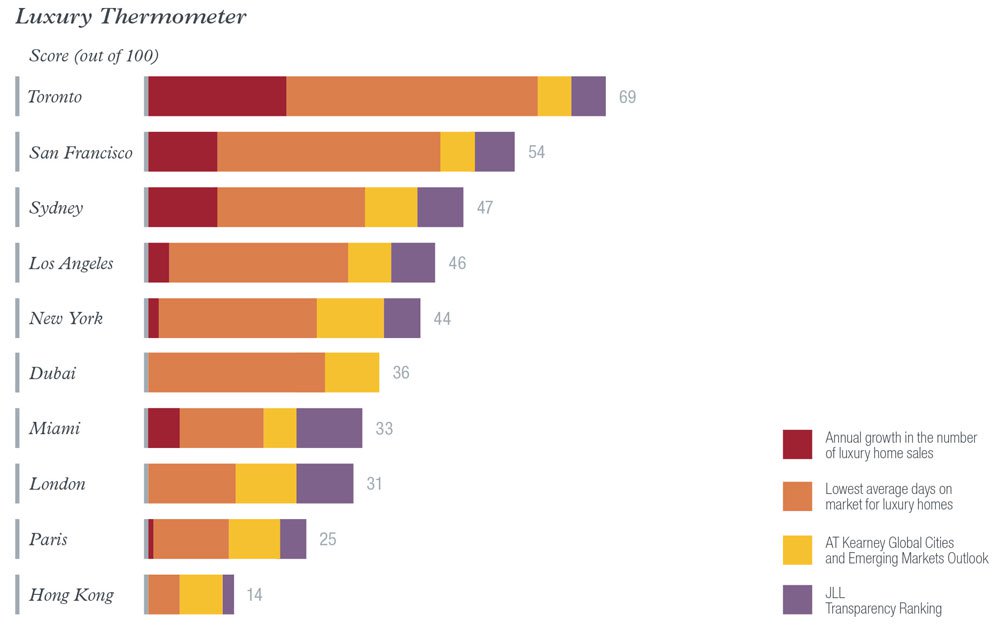

The Luxury Index evaluates overall prices and relative ‘luxuriousness’ of a market. Measuring the Luxury Temperature of the top prime property markets, however, offers a different perspective of the global marketplace. This category evaluates both growth and demand, and answers the elusive question: “Which was the hottest luxury housing market?” in a particular year. This ranking takes into account annual sales growth, time on market, and other independent city rankings.

Although London topped our Luxury Index list of top housing markets globally, Toronto ranked as the world’s hottest luxury real estate market in 2014 as a result of strong velocity in the number of prime property sales (up 37 percent over the prior year) and a torrid pace of sales (luxury homes sold in 31 days on average in Toronto).

KEY FINDINGS FROM THE 2014 INDEX

Note: The 2013 Index included Côte d’Azur in its rankings, which was replaced this year by Dubai to limit the Index to similar market types (Global Economic Hubs).